Remain Informed: As is true with any investment, maintaining up-to-date on global financial variables, central financial institution conclusions, geopolitical situations and geophysical realities will give buyers Perception into probable rate actions of gold and other precious metals.

Taking the time to check the various options can assist you to discover the best gold IRA organization or gold group. Popularity, encounter, metal options, costs and fees, plus much more go into creating a company reliable and successful.

The American Precious Metals Trade, or APMEX, associates with five custodians to retail store the gold bullion held within your gold IRA, which can be the broadest selection of any company within our survey.

To discover the best gold IRAs of 2025, we reviewed in excess of twenty firms within the services they offer, their account minimums and their expenses. From that record, we narrowed the selection to seven companies that characterize the best the field has to offer.

An organization’s success is measured by the value it offers its clientele. American Hartford Gold operates on a purchaser-first philosophy and has been given lots of positive opinions on platforms which include copyright. Great purchaser services and constant service enhancement are some of their crucial differentiators.

Savings Investment: Buyers can also fund their gold IRA account with a transfer from a savings account, funds, or other varieties of liquid savings.

It may possibly offset losses for American citizens to help get ready them to get a downturn. Regardless of whether the market is inside a positive pattern, gold together with other precious metals little by little gains worth eventually.

American Bullion is amongst the major-rated firms within the country for various causes. They’ve been around due to the fact 2009, offer you expenses as low as $75, and companion with Strata Have faith in and Delaware Depository, two of the highest-rated gamers in the gold vaulting industry.

Better charges: You cannot maintain your gold in your own home or inside a financial institution's safe deposit box. Alternatively, you must spend a custodian to retailer, insure, buy, ship, and transport your precious metals while in the IRA.

A broker will make an effort to encourage you that ETFs have comparable or improved returns and are superior simply because you never need a custodian, broker, or storage facility. In reality, an ETF is simply paper gold, you are not purchasing real gold. Therefore you are only buying a portion of an asset using an ETF, just like investing in a stock.

As per IRS guidelines, gold invested in an IRA or other retirement motor vehicle cannot be saved in someone's dwelling. Physical gold and other precious metals needs to be held in an IRS-accredited custodian to qualify for tax-deffered Added benefits.

In contrast to most of the Level of competition, they supply free index shipping for all of your precious metals, total with detailed registration and insurance policies at no added Expense for you.

Expenditures and costs: Resulting from storage and insurance useful content policies costs connected to physical gold possession, gold IRAs could charge increased costs than classic IRAs.

Soon after picking your custodian or gold group, the rollover method should begin immediately. Generally, this features:

Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Hailie Jade Scott Mathers Then & Now!

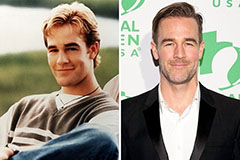

Hailie Jade Scott Mathers Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!